Inspiring Success in the Accounting World Shauna A. Wekherlien

Emma Todorovska

Marketing Manager at Next Generation Company

June 2023

Dive into the dynamic and constantly evolving world of accounting as we share inspiring stories from professionals who have made their mark in the Accounting industry.

In our latest interview series, we are thrilled to introduce you to a unique figure, affectionately known as the “Tax Goddess,” Shauna A. Wekherlien, CPA, MTax, CTC, and CTS.

Having founded Tax Goddess Business Services, PC, in 2004, Shauna A. Wekherlien, CPA, has earned the title of US’ Top 1% ranked, highly sought-after Tax Strategist.

Through this interview, we guide you into the successful journey of the Tax Goddess, who has saved her clients over $897,403,128 in taxes.

Shauna and her team at Tax Goddess use over 400 tax strategies to provide tailor-made solutions for their clients.

I am US’ top 1% tax strategist. So far, with over 4700 tax plans, I’ve been able to help my clients save over $897,403,128 tax money in total.

Shauna A. Wekherlien Tweet

Short Personal BIO

I am Shauna, the US’ Top 1% ranked, highly sought-after Tax Strategist.

I am passionate about helping successful business owners, entrepreneurs, and high-wage earners reduce their tax burden. Having founded Tax Goddess Business Services, PC in 2004, I have built a large global team of tax specialists who use “plain language” (not tax code) to help their clients create tax opportunities and manage tax risk legally.

For myself I can say that I am engaging and enthusiastic. I have been called a “pure joy” to work with. I make taxes “fun.”

My proprietary program “STC” (Strategic Tax Coaching), boasts a current average tax rate of 6.92% for my clients. With over 4700 tax plans written thus far, the Tax Goddess team has been able to help clients save over $897,403,128 in taxes.

I consider myself a zealous tax and financial educator. My background experience made me a highly demanded author and speaker with advanced communication and public speaking skills.

Over the past years, I have been featured in many magazines, such as Forbes and Entrepreneur, as well as hundreds of television and podcast appearances, such as CNN, CBS, NBC, the 10 Minute Entrepreneur, the Lifeblood Podcast, and the Action and Ambition Podcast.

Accounting Practice’s Name

Tax Goddess

Website

taxgoddess.com

Background and Entry into the Accounting Industry

I have been a tax strategist for the past 24 years, but the journey all started with my mother, who became overwhelmed and deeply frustrated with IRS notices and huge tax bills. To make my mother happy again and protect her from overpaying taxes again, I switched from Astrophysics to Taxes as my major and studied countless tax laws and strategies to help my mother. And guess what? I was able to get my mother’s taxes down to 7% annually! And the rest is history!

I started to love what I did. The smile that I see on clients’ faces when I deliver tax strategy results is JUST THE BEST PART! So, I became the “Tax Goddess,” helping taxpayers live worry-free lives with the freedom to achieve their dreams without financial constraints.

I am US’ top 1% tax strategist. So far, with over 4700 tax plans, I’ve been able to help my clients save over $897,403,128 tax money in total.

In which ways do your services help your clients? And even further, can you describe to our audience who is your ideal client?

My ideal clients are business owners, self-employed individuals, and high-wage earners who are tired of overpaying taxes and ready to create tax-free wealth with IRS-approved and effective tax strategies.

I became a tax strategist and founded Tax Goddess in 2004 because I wanted to give people access to the right information about taxes. And that is why I use all available platforms, including podcasts, to educate business owners on tax strategies and tax planning that can reduce their tax bills and help them reach their financial goals.

My core aim is to help 7-figure successful business owners reduce their tax burden and be able to channel tax savings toward business growth. Over the years, I discovered that taxes take a huge part of the profit and can hinder business opportunities.

My team and I at Tax Goddess have helped numerous clients reach their financial goals with legal and above-board tax strategies. My treasure trove of over 400 tax strategies ensures that each client gets customized strategies tailored to their needs.

From your perspective, what's the toughest problem today's accounting practices have to face?

One of the significant challenges that accounting practices face today is keeping pace with the rapidly evolving technological landscape. The digital revolution has brought about significant advancements in automation, artificial intelligence, cloud computing, and data analytics, which have revolutionized the accounting profession.

While these technological advancements offer tremendous opportunities for increased efficiency, accuracy, and improved client service, they also pose challenges for traditional accounting practices. Adapting to and harnessing these technologies requires significant investments in infrastructure, training, and upskilling of staff. Additionally, staying updated with the latest software and tools requires continuous learning and investment in professional development.

Furthermore, there is a growing demand from clients for real-time financial information and insights. Clients expect accounting practices to deliver value-added services beyond traditional bookkeeping and compliance. Accountants now need to provide proactive advisory services, leveraging data analytics and interpreting financial information to help clients make strategic business decisions. Meeting these expectations requires a broader skill set, including business acumen, data analysis, and effective communication.

To overcome these challenges, accounting practices need to embrace technology, invest in ongoing training and upskilling, adopt cloud-based accounting solutions, and enhance their advisory services. By leveraging technology effectively, staying updated with regulatory changes, and providing high-quality personalized services, accounting practices can position themselves as trusted advisors and navigate the evolving landscape successfully.

How has the accounting industry changed since you first started practicing?

Since I first started practicing as a tax strategist over 24 years ago, the accounting industry has undergone significant changes. Technological advancements, evolving regulatory landscapes, and shifting client expectations have shaped the profession in various ways.

One of the most prominent changes has been the widespread adoption of technology in accounting practices. However, with the advent of accounting software, cloud computing, and automation tools, the industry has experienced a remarkable transformation. These technological advancements have streamlined processes, improved accuracy, and enabled real-time access to financial data, empowering accountants to provide more timely and data-driven insights to their clients.

Client expectations have shifted as well. In the past, clients primarily sought accounting services for compliance purposes, such as tax preparation and financial statement preparation. However, today’s clients expect more proactive advisory services from their accountants.

They seek strategic guidance, financial planning, and assistance in making informed business decisions. This shift has prompted accountants to broaden their skill set and embrace a more consultative approach, leveraging their expertise to add value beyond traditional accounting functions.

Moreover, the rise of digital communication and remote work has transformed the way accountants interact with clients and collaborate within their teams. With the advancements in virtual meeting platforms, cloud-based collaboration tools, and secure client portals, accountants can now serve clients across geographical boundaries more efficiently and effectively.

How do you stay up-to-date with the latest trends and developments in accounting, and what resources do you rely on?

I prioritize staying up to date with the latest trends and developments in accounting to provide our clients with the most accurate and current information. My team and I at Tax Goddess employ several strategies to ensure I am well-informed and knowledgeable in my field.

First and foremost, I actively participate in continuing professional education programs and industry conferences. These events provide opportunities to gain insights into emerging trends and stay informed about regulatory changes. By attending seminars, workshops, and webinars, I enhance my technical knowledge and stay updated on the latest accounting practices and standards.

Also, I leverage various professional publications and journals dedicated to accounting and taxation. These publications often feature articles, case studies, and analyses of new regulations, tax planning strategies, and industry trends. They serve as valuable resources to expand my knowledge base and stay informed about recent developments in the accounting profession.

By combining these strategies – continuing education, professional publications, memberships, engagement with thought leaders, and networking -, I stay updated with the latest trends and developments in accounting. This commitment allows me to deliver the highest level of expertise and guidance to my clients while keeping pace with the dynamic and ever-evolving accounting landscape.

What are the most significant challenges facing accounting practice owners today, and how can they overcome them?

Accounting practice owners face various significant challenges in today’s dynamic business environment. Addressing these challenges requires proactive strategies and adaptability. Here are some of the most prominent challenges and potential solutions:

- Technology Adoption: Embracing technology and staying updated with the latest accounting software, cloud-based platforms, and automation tools can be challenging for practice owners. The solution lies in investing in technology infrastructure, providing training and resources to staff, and continuously exploring and implementing new technologies that can streamline processes, improve efficiency, and enhance client service.

- Talent Management and Retention: Finding and retaining skilled accounting professionals can be challenging, particularly in a competitive job market. To overcome this challenge, practice owners can focus on creating an attractive work environment, offering competitive compensation packages, providing opportunities for professional growth and development, and fostering a positive company culture that values and rewards employees’ contributions.

- Evolving Regulatory Landscape: Keeping up with changing regulations, tax laws, and accounting standards is a constant challenge for accounting practice owners. They can overcome this challenge by establishing a robust system for monitoring regulatory updates, investing in ongoing professional development and training, leveraging technology for compliance management, and establishing strong relationships with regulatory bodies and industry associations to stay informed about upcoming changes.

Can you share tips or advice for new accountants or accounting practice owners just starting?

Invest in Continuous Learning: The accounting field is constantly evolving, so it’s crucial to prioritize ongoing learning and professional development. Pursue certifications, attend seminars and workshops, and stay updated with the latest regulations and industry trends. A commitment to learning will help you stay competitive and provide the best service to your clients.

Build Strong Technical Skills: Develop a strong foundation in technical accounting skills. Understand accounting principles, financial statement analysis, tax laws, and compliance requirements. Solid technical skills will not only enhance your credibility but also provide a strong basis for providing accurate and reliable financial information.

Cultivate Effective Communication Skills: Communication is key in accounting. Develop strong written and verbal communication skills to effectively communicate financial information to clients, colleagues, and stakeholders. Clear and concise communication builds trust and ensures that your clients understand the complexities of their financial situation.

Embrace Technology: Embracing technology is essential for efficiency and staying competitive. Utilize accounting software, cloud-based platforms, and automation tools to streamline processes, enhance accuracy, and improve productivity. Stay informed about emerging technologies and explore how they can benefit your practice and clients.

What do you see as the future of the accounting industry, and how do you think it will evolve in the coming years?

The accounting industry is rapidly evolving due to the rise of technology, including automation, machine learning, and adaptive intelligence. As a result, accountants will focus more on analysis, while technology handles repetitive work.

Cloud computing and artificial intelligence are also rapidly growing, and automated accounting tasks are becoming fully automated by utilizing AI and machine learning technologies. Blockchain technology is also impacting the demand for accountants, enabling continuous and verified updating of accounting ledgers.

Accounting professionals will need to adapt to these technological changes and develop new skills to stay competitive. Additionally, accounting firms should implement flexible remote work policies, data security, advisory services, and automated processes through artificial intelligence and robotic process automation.

Finally, for those who wish to reach out to you or learn more about your work, what's the most effective method or place to contact you?

You can reach to Tax Goddess team by booking a consultation here:

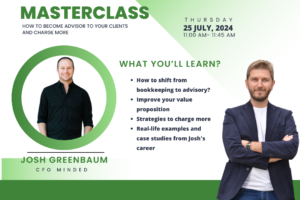

Masterclass with Josh Greenbaum

Transform Your Advisory Skills Watch Josh Greenbaum’s Masterclass Now! Missed the live session? Don’t miss out on the insights! Get exclusive access to Josh Greenbaum’s

Inspiring Success in the Accounting World: Viviane Hagopian

Inspiring Success in the Accounting World Viviane Hagopian Emma TodorovskaMarketing Manager at Next Generation CompanyOctober 2023 Linkedin-in In this inspiring interview, we delve into the

Managing a Remote Teams: Accountant’s Practical Guide

Managing a Remote Teams: Accountant’s Practical Guide Emma TodorovskaMarketing, Next Generation Company25.08.2023 Facebook-f Linkedin-in The landscape of accounting has undergone a seismic shift. Gone are

Accounting Practice Management Software: The Top 10 Picks

Accounting Practice Management Software: The Top 10 Picks Emma TodorovskaMarketing Manager at Next Generation CompanyAugust 2023 Linkedin-in In today’s digital age, staying at the top

Inspiring Success in the Accounting World Shauna A. Wekherlien

Inspiring Success in the Accounting World Shauna A. Wekherlien Emma Todorovska Marketing Manager at Next Generation Company June 2023 Linkedin-in Dive into the dynamic and

Inspiring Success in the Accounting World: Krista Sievers

Inspiring Success in the Accounting World Krista Sievers Emma TodorovskaMarketing Manager at Next Generation CompanyJune 2023 Linkedin-in Our guest today is Krista Sievers, the proud